Rental of industrial space in the Czech Republic reached a three-year high in the third quarter - interest of manufacturing companies helps

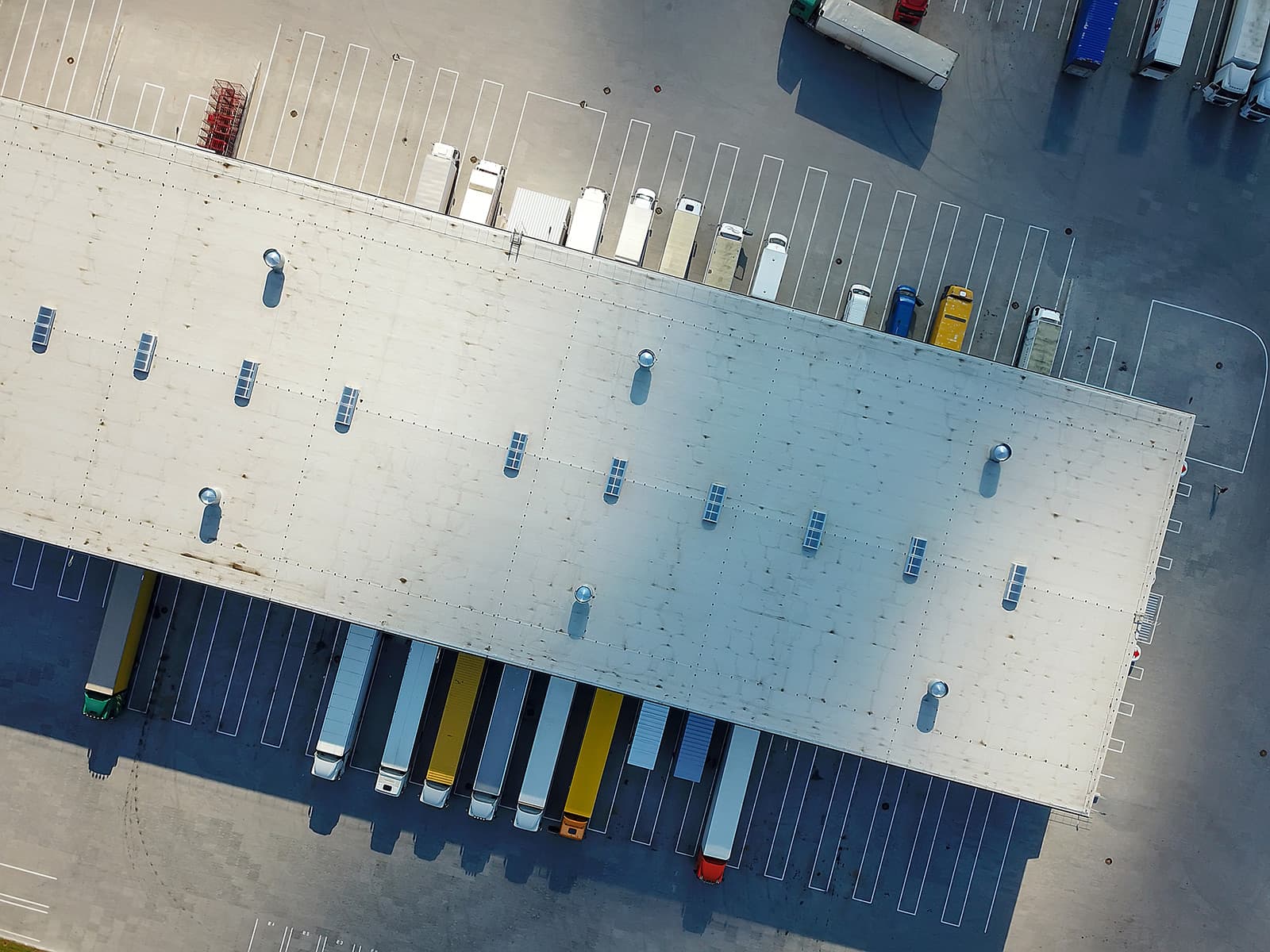

Net demand for industrial space in the Czech Republic reached a three-year high in the third quarter of this year. Gross take-up reached 642,045 sqm from July to the end of September. The share of new leases was unprecedented, amounting to 500,921 sqm in the period under review. According to real estate consultancy 108 REAL ESTATE, manufacturing companies leased a similar volume of premium industrial space as logistics: 163,449 sqm vs 177,570 sqm. Another new phenomenon is the achievement of a rent threshold of EUR 9 to 10 per sqm per month for selected urban logistics projects.